Circular Economy

Mar 11, 2021 |

Current factors influencing the recycling circuit

In March 2020, EU Environmental Commissioner Virginijus Sinkevičius presented a new circular economy action plan. As one of the most important components of the European Green Deal, it includes measures that encompass the entire lifecycle of products. In the future, for example, new products are to be designed with circular economy explicitly in mind. The overall goal: improving product durability and the capacity to upgrade, repair, and reuse products and to increase the percentage of recycled materials in new products. By 2030, all packaging produced in the EU is to be 100% reusable or recyclable.

A significant shift in favor of sustainability can currently be observed in society as well. According to a survey of 2,500 consumers in Germany by the EY (Ernst & Young) auditing and consulting company at the start of 2020, 68 percent of Germans would generally be willing to pay more for a product that demonstrably does no harm to the environment.

This growing awareness among politicians and in society of the need for the recycling of raw materials is affirmed in the recycling industry. Specifically in the recycling of plastics, the VDMA Professional Association of Waste and Recycling Technology sees an enormous amount of potential. For instance, the state-of-the-art recycling technology of today is already capable of recycling a large portion of the 14.4 million metric tons of plastics processed in Germany, with the exploitation of one metric ton of recycled plastic resulting in savings of between 1.45 and 3.2 metric tons of CO2-equivalent. There is just one problem: There is no sales market for recyclates.Recycled vs. virgin material – a question of profitability

ue to the extremely low demand for crude oil at the end of 2020, the price of new plastics has plummeted. As a result, packaging manufacturers are increasingly turning to virgin plastics and using less recycled material. This effect is being exacerbated by the higher prices of recyclates, which are often due to elaborate recycling processes. In order to produce recyclates profitably and offer competitive prices, recyclers need to rely on state-of-the-art technology. In addition, the profitability of the recyclates is directly dependent on the input material. The higher the quality and the greater the degree of homogeneity the latter has, the more economical the recycling process will be. And only if the quality and price of the recycled material is comparable to that of virgin material will manufacturers decide to use it.

Dr. Sarah Brückner, Managing Director at the VDMA Professional Association of Waste and Recycling Technology, states the following in no uncertain terms: “A market for secondary raw materials and thus a successful circular economy cannot be established long-term without the right legal framework."EU plastic tax – the solution?

The plastic tax that was passed in July 2020 is

regarded by the EU as being a potential solution for saving the recycled

material markets. Since January 1, 2021, this tax in the amount of 80 cents per

kilogram has been levied on all non-recyclable plastic waste, and it is

intended as an incentive for EU States to put less “dirty” plastic in

circulation. Above all, this involves a big adjustment for Germany, which –

according to the “Plastic Atlas” of the Heinrich Böll Foundation – is

considered the largest producer and processor of plastic in Europe.

One problem with the plastic tax: The tax on plastic waste mainly puts a burden on the taxpayers, not on the packaging industry that is putting the plastic into circulation. Viola Wohlgemuth, responsible for the topics of consumption, textiles, and plastic at Greenpeace, is critical when it comes to the tax. According to a Spiegel article, she is of the opinion that – to develop a genuine steering effect – the plastic tax would already have to be levied on the product packaging as soon as it enters the market.

The percentage of recycled materials needs to be increased. But how?

The reliable availability of recyclates on the market could reduce the demand for primary raw materials. To achieve this, however, recyclers, manufacturers, and consumers need to work hand in hand.

Optimizing waste collection and recycling

Waste collection systems represent a significant first step in each waste management process and play a central role in its overall success. There are a large number of systems for collecting household waste in Europe. Today, the explicit collection of packaging and other household goods primarily consisting of plastic, aluminum, paper, and glass offers an attractive solution for maximizing the quantity of recycled waste. For packaging waste to actually be recycled, however, it is also necessary for the consumers to cooperate, not just the manufacturers. The basic prerequisite for waste preparation is homogeneous separation. Packaging waste can only be recycled if it is disposed of properly.

And yet there is another problem as well: If packaging consists of multiple material layers or a combination of materials that cannot be separated after use, the recycling process becomes much more time-consuming and costly. Some packaging is made of firmly adhered combinations of different kinds of plastic. In this case, they are generally put with one material category in the sorting system, thereby reducing the degree of homogeneity.

The increasing demand for recyclates – mainly recycled

PET – to use in plastic packaging also harbors the risk that not enough

secondary raw materials of sufficient quality will be available in the future.

It has long been the case in Germany that beverage bottles are made of nearly

30 percent recycled PET. However, IK

Industrievereinigung Kunststoffverpackungen e.V.

believes the PET beverage bottle market is at risk. “Only a few countries in

Europe already have a deposit system for PET beverage bottles as effective as

the one in Germany,” says Dr. Isabell Schmidt, the Managing Director of

Circular Economy at IK.

To ensure that the industry has a sufficient supply of raw recycling materials, the separate collection and recycling of PET beverage bottles throughout the EU will need to be massively expanded. Otherwise, there could be a ban on the marketing of PET beverage bottles. To avoid this, IK is pushing for the development of a European market observatory that will primarily have the responsibility of keeping an eye on the availability of recycled PET materials in food contact quality. If recycled raw materials cease to be available at acceptable prices in the required quantities and qualities, then the EU requirements for the use of recycled materials should be suspended, says Dr. Schmidt.

Challenge for manufacturers and processors of plastic: high-quality recyclates thanks to innovative technologies

The most important prerequisite

for manufacturing high-quality secondary raw materials is homogeneous material.

The solution to this involves sensor-based material analysis systems and sorting devices that can sort precisely by shape, color, and material type. In addition, metal separators can identify and filter out even the finest metal particles in the recycled material. This makes it possible to obtain recycled material with purities of up to 99 percent from substandard starting material.

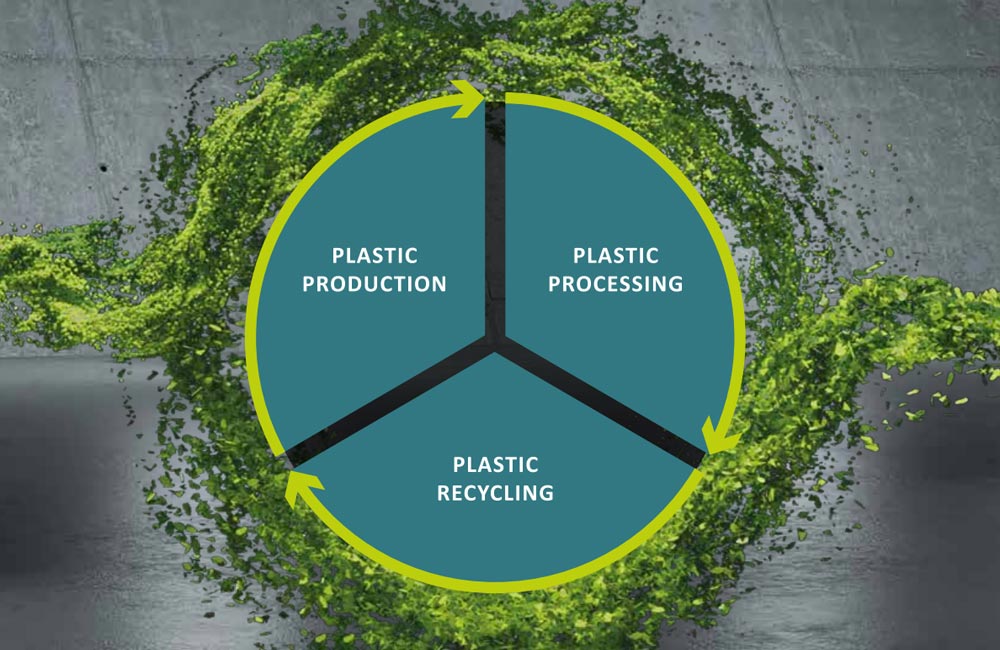

Sesotec supports all industrial areas of the plastics cycle with innovative solutions -

for more profitability, quality and productivity.

Discover our Circular Economy Systems.

Design for recycling

Politicians react to this challenge with ambitious requirements in legislation, such as in packaging law. When designing products in the future, manufacturers will have a new challenge with regard to holistic and sustainable product development. According to EU Commission requirements, all future products must be designed and produced in such a way that the packaging either is reusable and recyclable after use or consists of renewable raw materials.

And this is where the catch 22 occurs: Recyclable products can only be manufactured if there are sufficient secondary raw materials. And manufacturers will only be able to operate profitably if sufficient secondary raw materials are available at affordable prices.

Conclusion

Both society as well as politicians have an ardent

desire to close the circle. While the EU has pointed in the basic direction and

passed initial laws, a legally mature concept for actually achieving the

ambitious climate protection goals and completely closing the circle has yet to

emerge. But one thing is certain: Until this is the case, each stakeholder –

from the manufacturer and processor to the consumer and recycling companies –

must have a willingness to contribute proactively to the cause. However, such

willingness will only be prevalent if all involved possess a certain level of

planning security. Only then will they be in a position to work profitably.

New E-Book: The Circular Economy - Challenges and opportunities for Recyclers and plastics processors

In this comprehensive e-book, you will gain insight into the most important factors of the Circular Economy. In particular, we look at the goal of creating a circular economy that must be profitable not only for people and the environment but also for recyclers, plastics manufacturers and processors.